How to Make Money Stock Trading Online

Trading stocks online has become an increasingly popular way to make money for individuals looking to capitalize on the stock market’s potential. Whether you’re a beginner or an experienced investor, there are several strategies and tools you can use to maximize your earnings. In this article, we’ll explore the various aspects of online stock trading, from understanding the basics to implementing advanced trading techniques.

Understanding the Basics of Online Stock Trading

Before diving into the strategies and tools, it’s crucial to have a solid understanding of the basics of online stock trading. Here’s a quick rundown:

- Stock Market: The stock market is a place where shares of publicly-traded companies are bought and sold. It provides a platform for investors to buy and sell stocks, bonds, and other financial instruments.

- Stocks: Stocks represent ownership in a company. When you buy a stock, you become a shareholder and have a claim on the company’s assets and earnings.

- Brokers: Brokers are financial intermediaries who facilitate the buying and selling of stocks on your behalf. They charge a commission for their services.

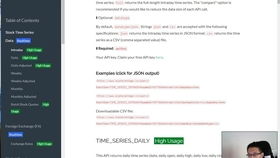

- Online Trading Platforms: Online trading platforms are websites or applications that allow you to buy and sell stocks, bonds, and other financial instruments. They provide real-time market data, research tools, and trading capabilities.

Now that you have a basic understanding of online stock trading, let’s explore some strategies to help you make money.

Strategies for Making Money in Online Stock Trading

There are several strategies you can use to make money in online stock trading. Here are some of the most popular ones:

1. Day Trading

Day trading involves buying and selling stocks within the same trading day. The goal is to profit from short-term price movements. Here are some tips for successful day trading:

- Choose the Right Stocks: Focus on stocks with high liquidity and volatility, as they are more likely to have significant price movements.

- Use Technical Analysis: Technical analysis involves analyzing historical price and volume data to predict future price movements. Use charts, indicators, and patterns to make informed trading decisions.

- Manage Risk: Set stop-loss orders to limit potential losses and avoid holding losing positions for too long.

2. Swing Trading

Swing trading is a medium-term trading strategy that involves holding stocks for a few days to a few weeks. The goal is to capture price movements over a longer period. Here are some tips for successful swing trading:

- Use Fundamental Analysis: Analyze a company’s financial statements, earnings reports, and industry trends to identify potential opportunities.

- Focus on High-Quality Stocks: Look for companies with strong fundamentals, such as a good track record of earnings growth and a strong market position.

- Set Realistic Profit Targets: Determine your profit targets based on technical analysis and market conditions.

3. Long-Term Investing

Long-term investing involves holding stocks for several years or more. The goal is to benefit from the company’s growth and dividends. Here are some tips for successful long-term investing:

- Research Companies: Conduct thorough research on companies you’re interested in, including their business model, management team, and financial health.

- Rebalance Your Portfolio: Regularly review and adjust your portfolio to ensure it aligns with your investment goals and risk tolerance.

Focus on Dividend-Paying Stocks: Dividend-paying stocks can provide a steady stream of income and potentially increase in value over time.

Tools and Resources for Online Stock Trading

There are several tools and resources available to help you make money in online stock trading:

- Online Trading Platforms: Platforms like TD Ameritrade, ETRADE, and Robinhood offer a variety of tools and resources to help you trade stocks online.

- Financial News and Research: Websites like Bloomberg, CNBC, and Seeking Alpha provide up-to-date financial news, market analysis, and research reports.

- Technical Analysis Tools: Tools like Thinkorswim, MetaTrader